how to calculate tax

Calculate your total tax due using the AZ tax calculator update to include the 202223 tax brackets. Each province sets its own land transfer tax rates as do some municipalities.

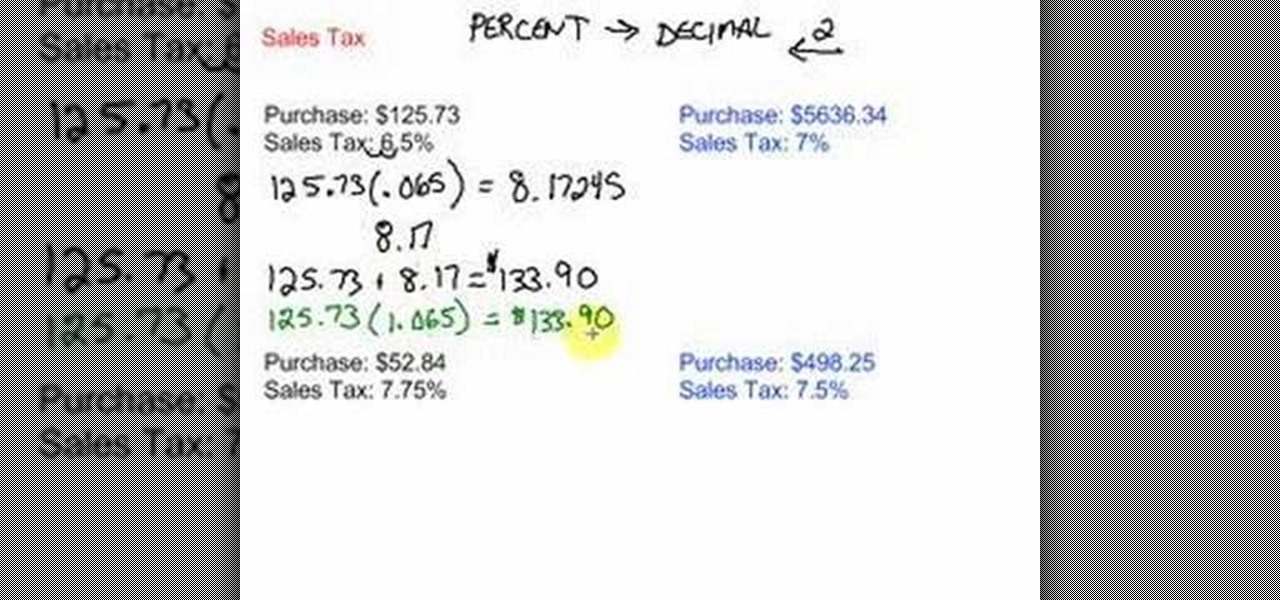

How To Calculate Sales Tax And Add It To The Total Amount

The easiest way to calculate your tax bracket in retirement is to look at last years tax return.

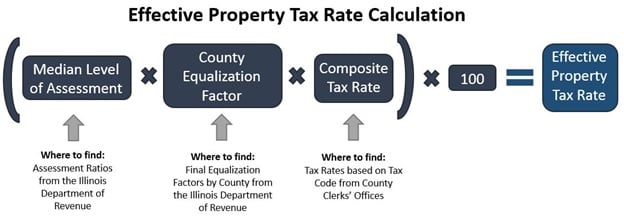

. District tax rates range from 01 to 1 percent and are added to the state sales tax rate as a surtax. The tax calculator allows taxpayers and agents to work out the amount of LBTT payable on residential non-residential or mixed property transactions and non-residential lease transactions based on the rates and thresholds. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate.

Keep in mind that sales tax rates and laws are always changing so the best way to stay on top of things is to use TaxJar which will help you charge. This also applies to some motorhomes. In the condition you can figure out the sales tax as follows.

MAGI is not included on your tax return but you can use the information on your 1040 to calculate it. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. The Arizona State Tax calculator is updated to include.

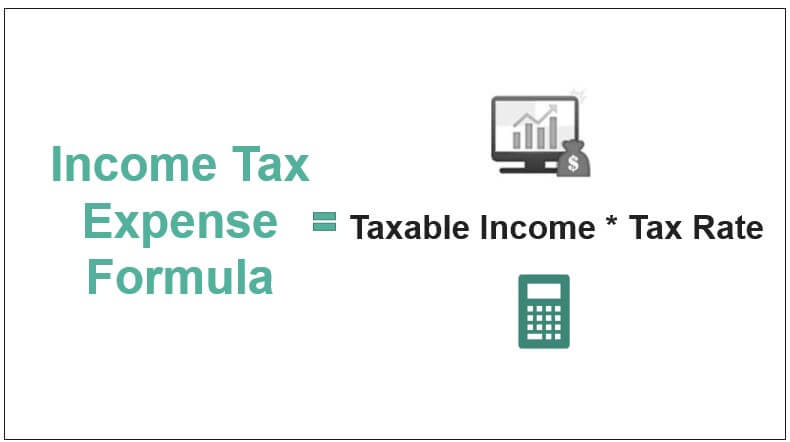

Gross earnings - business expenses net earnings. The sales tax is calculated by multiplying the sale price by the current combined state and local sales tax rate. For simplicitys sake the tax tables list all income over 3000 in 50 chunks.

Next figure the taxable portion by subtracting the tax-free portion from your total distribution. Thereafter compute your federal taxable income and the consequent taxThis encompasses establishing your itemized deductions calculating the said deductions and then finally subtracting them. Working tax credit basic element.

Steps for Income Tax Calculation. In some regions the tax is included in the price. 1 The type of taxing unit determines which truth-in-taxation steps apply.

This calculator is FREE to use and will give you an instant Australian tax refund estimation. Medicare tax rate for 2019 is 145 for the employee portion and 145 for the employer portion. If you work at least 30 hours a week youll be paid extra.

Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund. Rates include the 1 property tax administration fee. Rates include special assessments levied on a millage basis and levied in all of a township city or village.

The latest Federal tax rates for 202223 tax year as published by the IRS. Calculate the taxable portion of your early IRA withdrawal. Long Term Capital Gains Calculator.

Select the cell you will place the sales tax at enter the formula E4-E41E2 E4 is the tax-inclusive price and E2 is the tax rate into it and press the Enter key. For 2020 look at line 10 of your Form 1040 to find your taxable income. To illustrate lets say your taxable income Line 15 on Form 1040 is 41049.

Youll need to find your adjusted gross income line 8b and add several deductions back to it including deductions for IRAs student loan interest and tuition certain types of income losses and more. The tax is different if the property or land is in. Say a restaurant outing produced a before-tax price of 205 in the Chicago area outside of the McPier Tax Zone so that the sales tax rate is 1025 percent.

Unlike your 1099 income be sure to input your gross wages. Welcome to our Australian Tax Refund calculator. Figure the tentative tax to withhold.

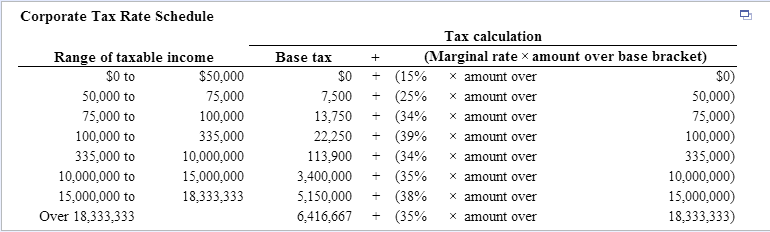

The tables only go up to 99999 so if your income is 100000 or higher you must use a separate worksheet found in the Form 1040 Instructions to calculate your tax. Rates also include special assessments levied on a millage basis for police fire or advanced life support and levied township-wide excluding a village. Then you can estimate your taxable income by subtracting allowable deductions from your AGI.

Account for dependent. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes. First tax payment when you register the vehicle Youll pay a rate based on a vehicles CO2 emissions the first time its registered.

Calculate the amount that equals 9235 of your net earnings which is the amount subject to self-employment tax. State and local sales tax rates vary from product to product but are not always applied to services it depends on the type of service and the stateFor more information on calculating sales tax rates this post offers more information. This calculator can be used to calculate long term capital gains LTCG and the corresponding LTCG tax liability for listed shares and units of equity oriented mutual fund schemes sold between 142018 and 3132019 both dates inclusive.

Scotland - pay Land and Buildings Transaction Tax. The other main federal payroll tax is for Medicare. This is if youre a couple making a joint claim.

Here are the steps to calculating the self-employment tax. This is always included if youre considered to be on a low income and qualify for working tax credit. Working tax credit 30-hour element.

Use the calculator above to find the land transfer tax based on your location or keep reading to find out how land transfer tax is calculated where. After you calculate your tax on taxable income subtract credits and make other adjustments to arrive at the final net federal income tax amount. How to calculate land transfer tax.

This box is optional but if you had W-2 earnings you can put them in here. Land transfer taxes are calculated based on the purchase price of your property. As with Social Security use your gross pay your pay before any taxes are taken out for this calculation.

Working tax credit couplesecond adult element. Wales - pay Land Transaction Tax if the sale was completed on or after 1 April 2018. If you need to calculate your federal income tax start by estimate your adjusted gross income or AGI.

First use the worksheet found on page 5 of IRS Pub 15-T to calculate the adjusted annual wage amount. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. If youve ever worked Down Under you probably paid tax and are due an Australian tax refund.

In all tax rates in California range from 75 percent to over 10 percent depending on the area. Again there may be more than one district tax applied to the sales tax in a given area. Under both the income tax regimes tax rebate of up to Rs 12500 is available to an individual taxpayer under section 87A of the Income-tax Act 1961.

This would effectively mean that individuals having net taxable income of up to Rs 5 lakh would not pay any income tax irrespective of the tax regime chose by them. See below to learn how to calculate this tax. Meaning your pay before taxes and other payroll deductions are taken out.

Calculate the adjusted wages. This too is a flat tax rate. For traditional IRAs first figure the tax-free portion by multiplying your distribution by the amount of nondeductible contributions in the IRA divided by the IRA value.

And now you can get the sales tax easily. First and foremost ascertain your adjusted gross income.

Income Tax Expense On Income Statement Formula Calculation

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Calculate Your Community S Effective Property Tax Rate The Civic Federation

How To Calculate Payroll Taxes In 5 Steps

How To Make An Equation That Calculates The Price Before Tax Quora

How To Calculate Income Tax In Excel

Solved Using The Corporate Tax Rates Calculate The Tax Chegg Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Quiz Worksheet How To Calculate Property Taxes Study Com

Do You Know How To Calculate After Tax Returns Russell Investments

4 Ways To Calculate Sales Tax Wikihow

How To Calculate Income Tax In Excel

Reverse Sales Tax Calculator Calculator Academy

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Math How To Calculate Taxes For Single Or Married With Given Information In C Stack Overflow

Comments

Post a Comment